What is Capital Allowance?

Capital Allowance is used as a subsidy to for the depreciation of fixed assets. Capital allowance is given to reduce the tax payable for the capital.

Capital allowance is only applicable for businesses and not individuals. The nature of the capital and the purpose of the capital must be for the use of a business.

Examples of claims and property types:

- The purchase of new or second hand property.

- The repair, refurbishment , or extension of properties like :

- Offices

- Retail and shopping centres

- Restaurants

- Factories

- Hospitals

- Hotels

- Banks

- Rental properties – apartments and houses

- Landlord repair works

How to calculate capital allowance?

Capital allowances consist of an initial allowance (IA) and annual allowance (AA).

Initial allowance

IA is fixed at the rate of 20% based on the original cost of the asset at the time when the capital was obtained.

Annual allowance

Annual allowance is a flat rate given annually according to the original cost of the asset. The annual allowance is distributed each year until the capital expenditure has been fully written off.

Annual allowance rates depend on the types of assets. The rates are as follow:

- Motor vehicle is 20%

- Plant and Machinery is 14%

- Other assets like furniture and office equipment is 10%

Capital Allowance For Motor Vehicle

Motor vehicle for Capital Allowance is classified into 2 categories.

- Passenger / private vehicle

- Commercial vehicle (van, lorry, and bus)

What is eligible for capital allowance?

Eligible for capital allowance:

- Basic Accessories and registration fees which is required by the road transport department (RTD)

What is not eligible for Capital allowance but are tax deductibles are:

- Road tax, insurance, and hire purchase interest

Not eligible for capital allowance and are non-tax deductibles:

- Car reserve price, and tender and service fees are These are private expenses and are prohibited under Subsection 39 of the act

How To Calculate Capital Allowance?

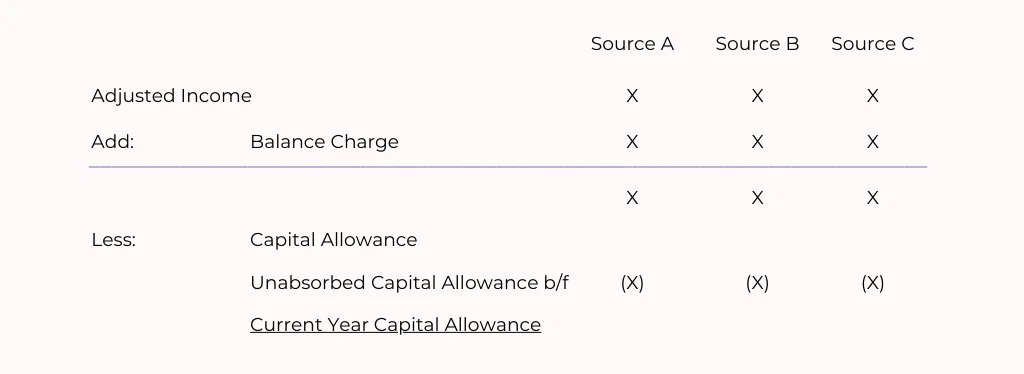

* Any unabsorbed capital allowance will be carried forward to next year. Do note that any deduction of capital allowance is only restricted to the same business source.

Example of Capital Allowance Calculation

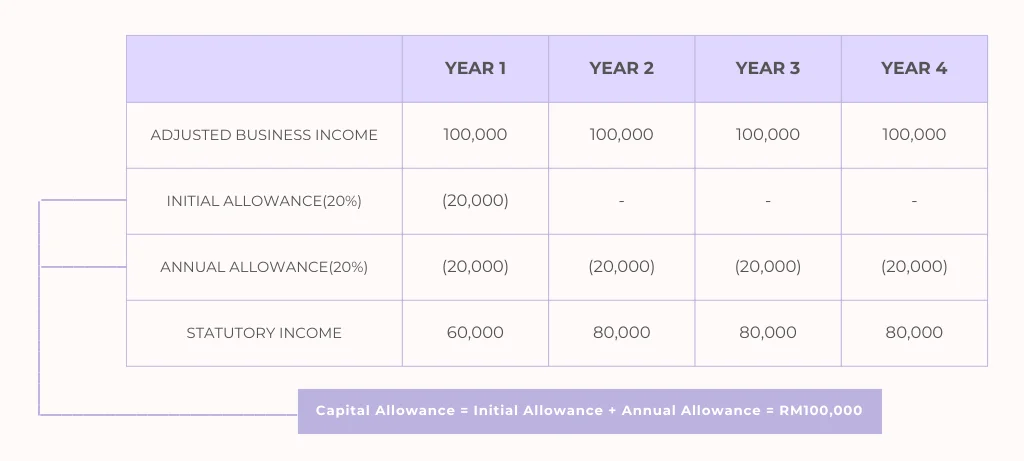

Example 1: Motor Vehicle With Full Amount Qualifying Expenditure

ACB SDN BHD acquired a car worth RM100,000 in 2018.

Q1: What is the maximum capital allowance allowed to claim?

Answer: RM100,000

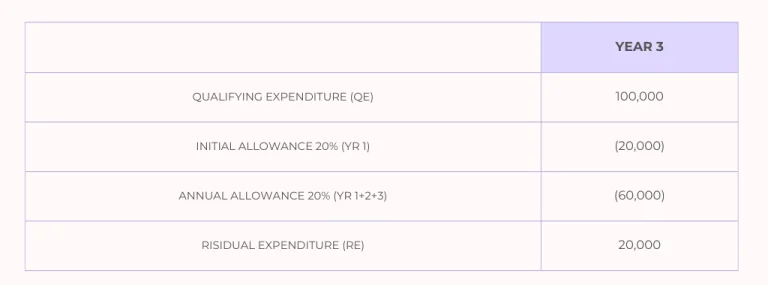

Q2: After 2 years (2020), what is the Residual Expenditure (RE)?

Answer: RM20,000

Q3: He decided to dispose his car for RM98,000 in 2020. Any Balancing Charge or Allowance?

| Deemed Disposal Value | = | RM98,000 |

| Since Disposal Value > RE, | ||

| Balancing Charges | = | Disposal Value – RE |

| = | RM98,000 – RM20,000 | |

| = | RM78,000 | |

Answer: Balancing charges is RM78,000

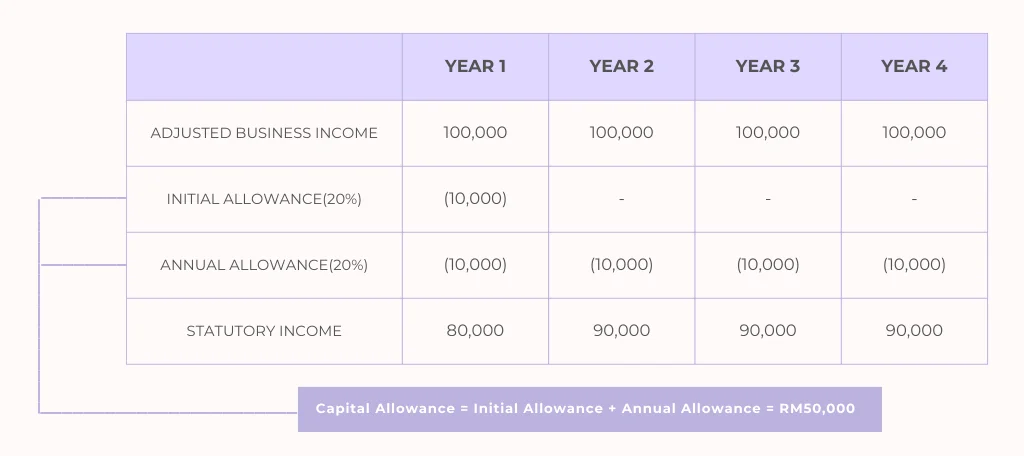

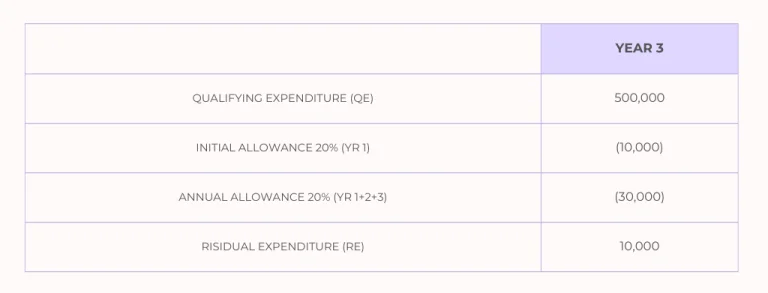

Example 2: Motor Vehicle With Limited Qualifying Expenditure

ACB SDN BHD acquired a car worth RM198,000 in 2018.

Q1: What is the maximum capital allowance allowed to claim?

Answer: RM50,000

Q2: After 2 years (2020), what is the Residual Expenditure (RE)?

Answer: RM10,000

Q3: He decided to dispose his car for RM98,000 in 2020. Any Balancing Charge or Allowance?

| Deemed Disposal Value | = | (Disposal Price / Purchase Price) x QE |

| = | (RM98,000 / RM198,000) x RM50,000 | |

| = | RM24,747 | |

| Since Disposal Value > RE, | ||

| Balancing Charges | = | Disposal Value – RE |

| = | RM24,747 – RM10,000 | |

| = | RM14,747 | |

Answer: Balancing charges is RM14,747

Benefits of claiming capital allowance?

Claiming capital allowance is an immediate tax / cash benefit. This can help to increase your cash low and keep cash in your business. By claiming capital allowance, you also reduce you tax liability. There is not restriction on high earners for this allowance and it is not a specified relief.

Who can claim capital allowance?

Anyone who has built/ bought property or has gained a capital expenditure on a non-current asset which is used for the purpose of trade or businesses.

Common mistakes made when claiming capital allowance:

- Insufficient supporting documents to support your claim

- Over-claim: incorrect inclusion of expenditures

- Under-claim: accidentally excluding some qualified expenditures.

Effects of incorrect capital claims:

If you underclaimed you capital allowance, you loose out on the actual amount of tax savings that you are entitled to.

If you overclaimed your capital allowance, you run the risk of repayment for underpaying your taxes, penalties and also being charged for tax fraud.